Feie Calculator - The Facts

Table of Contents6 Easy Facts About Feie Calculator ExplainedFeie Calculator Things To Know Before You Get ThisFeie Calculator Fundamentals ExplainedSome Ideas on Feie Calculator You Need To KnowFeie Calculator Can Be Fun For Anyone

He sold his U.S. home to develop his intent to live abroad completely and applied for a Mexican residency visa with his partner to assist fulfill the Bona Fide Residency Test. Neil points out that purchasing residential property abroad can be testing without first experiencing the location."We'll most definitely be outdoors of that. Also if we come back to the US for doctor's consultations or organization calls, I question we'll spend greater than 1 month in the United States in any provided 12-month period." Neil emphasizes the value of stringent tracking of U.S. sees (Foreign Earned Income Exclusion). "It's something that people need to be really thorough regarding," he claims, and suggests deportees to be cautious of common mistakes, such as overstaying in the united state

The 8-Minute Rule for Feie Calculator

tax obligation responsibilities. "The reason that U.S. tax on globally revenue is such a big bargain is because numerous people forget they're still subject to U.S. tax also after transferring." The united state is among minority nations that tax obligations its people despite where they live, meaning that even if an expat has no earnings from united state

tax return. "The Foreign Tax obligation Credit scores enables people operating in high-tax nations like the UK to offset their united state tax obligation by the amount they've currently paid in taxes abroad," says Lewis. This makes sure that expats are not taxed two times on the exact same income. However, those in reduced- or no-tax countries, such as the UAE or Singapore, face extra obstacles.

The Definitive Guide for Feie Calculator

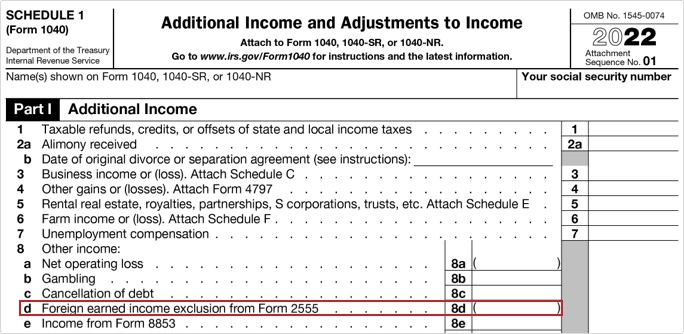

Below are a few of one of the most regularly asked see this page inquiries concerning the FEIE and other exclusions The Foreign Earned Revenue Exclusion (FEIE) allows united state taxpayers to omit as much as $130,000 of foreign-earned income from federal income tax, decreasing their united state tax obligation liability. To get FEIE, you must fulfill either the Physical Existence Test (330 days abroad) or the Bona Fide Home Test (prove your key residence in an international country for a whole tax obligation year).

The Physical Existence Examination additionally requires United state taxpayers to have both a foreign earnings and a foreign tax home.

Everything about Feie Calculator

An earnings tax obligation treaty between the united state and another country can aid protect against double tax. While the Foreign Earned Earnings Exclusion minimizes taxable revenue, a treaty might supply extra advantages for qualified taxpayers abroad. FBAR (Foreign Savings Account Report) is a called for filing for U.S. people with over $10,000 in international economic accounts.

Qualification for FEIE depends on conference specific residency or physical visibility examinations. He has over thirty years of experience and now specializes in CFO services, equity settlement, copyright taxes, cannabis taxation and separation relevant tax/financial preparation issues. He is an expat based in Mexico.

The foreign made earnings exemptions, sometimes referred to as the Sec. 911 exclusions, exclude tax on wages made from functioning abroad. The exemptions make up 2 components - an earnings exclusion and a real estate exemption. The complying with Frequently asked questions talk about the advantage of the exclusions consisting of when both spouses are expats in a general fashion.

The 10-Second Trick For Feie Calculator

The income exclusion is now indexed for inflation. The maximum annual earnings exemption is $130,000 for 2025. The tax benefit omits the earnings from tax obligation at lower tax obligation prices. Previously, the exemptions "came off the top" lowering income based on tax on top tax prices. The exemptions might or might not reduce earnings used for various other functions, such as IRA limitations, child credit reports, personal exceptions, and so on.

These exemptions do not excuse the earnings from US taxation but merely offer a tax reduction. Keep in mind that a solitary individual working abroad for every one of 2025 who made concerning $145,000 without various other earnings will have taxed earnings lowered to zero - efficiently the very same answer as being "free of tax." The exemptions are calculated each day.